Audio bite.

Funding Future Investment – Raise new capital funds or is it time to sell up?

Investing in new technologies and funding new skills and fresh talent, all while maintaining independence and your firms unique culture, is no doubt a tall order. The pressure to embrace and resolve these matters is relentless. Competitive pressure, productivity and workload pressure or the pressure of modernizing and transforming your business in the face of near constant developments in technology – all bring the need for capital funds into focus. Some firms rely on a strong balance sheet with reinvested profits. Others draw on modest capital injections from retained earnings, bank lending, or new equity partners, or external backing.

This AGN Global Business Voice publication synthesizes seven strategic capital-raising routes available to AGN member firms. Each has unique advantages, trade-offs. Their strategic fits depending on the firm’s objectives, risk appetite, and ownership philosophy.

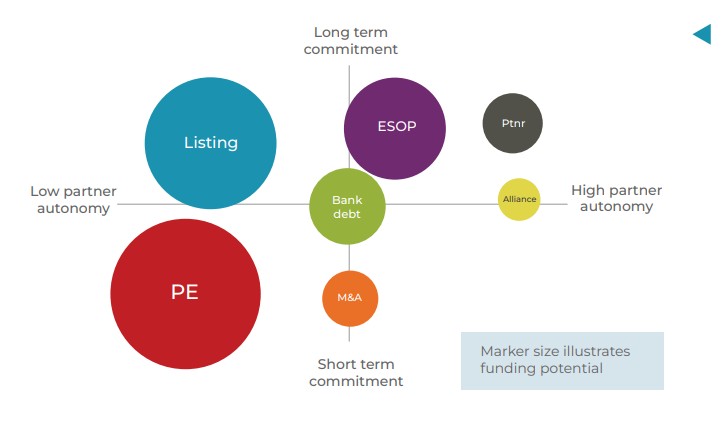

Strategic Financing Options Mapped by partner autonomy,

timescale commitment &

funding potential

Left, is an illustrative schematic comparing relative partner autonomy, timescale commitment and funding

potential between options. Individual circumstances and deal structures vary widely, impacting this assessment, and

below we explore the potential pros and cons of all these approaches.

On the move?

Tune into our mini podcast on Spotify at the end of this article for a quick summary of the key insights.

Below is AGNs checklist of matters you should consider at the start of your journey to raise capital resources for your firm: The checklist would make useful section headings for an internal project report.

| AGN Capital Raising Checklist… At a very high level there are a series of practical steps that members should consider at the beginning of a journey to raising required capital funding: |

|---|

| 1. Conduct a strategic capital needs assessment |

| 2. Evaluate your current financial and ownership position |

| 3. Map all viable funding options |

| 4. Engage and align key stakeholders |

| 5. Develop a capital raising plan |

| 6. Strengthen your attractiveness to investors or lenders |

| 7. Seek specialist advice early |

| 8. Use AGN tools & networks |

| 9. Balance growth with culture |

| 10. Plan for integration, repayment, or exit |

Funding Future Investment 1: Strategic Alliances and Partnerships

Perhaps not the most obvious starting point, but perhaps it’s possible to avoid the need for raising capital altogether? Strategic alliances involve partnering with another organization to drive mutual growth—without full mergers. Accounting firms may align with other firms, consulting or tech businesses, or join investor-backed networks. These arrangements aim to leverage strengths such as client bases, expertise, or technology access. While alliances typically don’t bring a large one-time capital injection, they often reduce capital needs and generate new revenue.

| Benefits | Challenges |

|---|---|

| 1. Access to Resources and Technology Alliances help firms access tech or skills they lack in-house. A mid-sized firm could benefit from a partner’s AI auditing tools, cybersecurity capabilities, or back-office systems—improving digital maturity without full cost burden. | 1. Limited Capital Injection Unless the alliance includes investment, there’s no direct cash inflow. While some models (e.g., VC-backed alliances) do invest in member firm tech, most deliver value indirectly via referrals or shared tools. |

| 2. Expanded Services and Market Reach By teaming up, firms can offer broader solutions—e.g., combining tax services with IT consulting. Alliances open new markets and client opportunities that would otherwise be inaccessible alone. | 2. Coordination Complexity Alliances require effort to align on fees, roles, and quality. Joint projects need clear structures. Mismanagement can confuse clients or delay outcomes. |

| 3. Shared Costs and Risk Collaborative initiatives split costs. Firms might jointly develop a platform or co-market services, lowering financial exposure for each. | 3. Potential for Conflict or Dependency Disagreements can arise if goals diverge. Over-reliance on a partner for key resources creates risk if the relationship ends or underperforms. |

| 4. Independence Retained Alliances preserve local identity and control. Firms keep their branding and decision-making while benefiting from scale advantages like training and infrastructure. | 4. Brand Dilution If not carefully positioned, a firm’s individual identity may be overshadowed. Success may be attributed to the alliance instead of the firm, affecting perception and control over marketing. |

| 5. Talent and Client Appeal Affiliation with broader networks or firms enhances credibility. It reassures clients and appeals to recruits who want big-firm resources with small-firm culture. | 5. No Guaranteed Results Alliances require active participation. Without follow-through, benefits may not materialize. Unlike mergers, alliances can fade if neglected. |

Suitability for Medium-Sized Firms

Alliances are ideal for firms seeking capability growth over sheer size. For example, a 15-partner firm strong in compliance might partner with a consulting boutique to add advisory depth. Joining an international network allows service expansion across borders, and tech alliances can support transformation goals at lower costs.

Ownership Impact

Most strategic alliances do not involve equity transfer. Firms remain independently owned. For instance, if a tax firm allies with a tech consultancy, ownership doesn’t change—just a contractual collaboration forms.

Some newer alliance models include small equity stakes—usually in non-attest services—funded by investors. Even then, these are minority holdings and preserve autonomy. Any equity dilution is typically minimal and structured to

retain partner control.

Application Across Timeframes

Short-Term

Quick wins may include shared client opportunities or access to new tools. For example, a firm could immediately pitch for a larger client using its partner’s capabilities.

Medium-Term (1–3 yrs)

With active collaboration, referrals

grow, services integrate, and costs reduce. For example after two years, a firm might see 10–15% of new business linked to

the alliance.

Long-Term (3–5+ yrs)

Strong alliances can deepen, evolve into mergers, or become

a firm’s key strategic pillar. International affiliations, for example, support consistent

innovation and client expansion over time.

Suitability for Medium-Sized Firms

Alliances are ideal for firms seeking capability growth over sheer size. For example, a 15-partner firm strong in compliance might partner with a consulting boutique to add advisory depth. Joining an international network allows service expansion across borders, and tech alliances can support transformation goals at lower costs.

Conclusion

Strategic alliances offer a balanced path to growth. While not suited for firms needing fast capital, they enable mid-sized practices to stay competitive, broaden their offer, and access tech—all without giving up control. For firms that want to remain themselves but do more, alliances are a powerful tool. They amplify capabilities, reduce cost burdens, and allow firms to punch above their weight—especially when well-managed and mutually beneficial.

Funding Future Investment 2: Private Equity Investment

PE firms see medium-sized accountancy practices as attractive due to recurring revenues, strong client relationships, and potential for digital and service transformation. These firms provide a foundation for platform-building, where PE can drive rapid growth through add-on acquisitions and operational efficiency.

Why Private Equity Is Interested in Accounting Firms:

PE firms look for:

- Strong EBITDA performance

- Growth potential

- Recurring revenue

- Niche expertise

- Leadership & succession

- Digital readiness

- Cultural fit

Firms demonstrating digital maturity, operational efficiency, and strategic clarity are especially appealing Introduction. Firms with specialist services (e.g., tax, corporate finance, ESG, or tech consulting) often command higher valuations, especially when they’ve embraced digital tools and can scale.

| Benefits | Challenges |

|---|---|

| 1. Significant Capital Injection PE provides large amounts of capital to fund expansion, technology upgrades, M&A, and new service lines—enabling faster transformation than organic growth alone. | 1. Loss of Independence PE investors typically require control or strong influence—meaning partners may lose autonomy over key decisions and the firm’s strategic direction. |

| 2. Liquidity for Partners Partners can cash out part or all of their equity, offering an exit path or personal wealth diversification—particularly useful for retiring founders. | 2. Cultural Clash Risk The commercially-driven approach of PE can conflict with traditional partner culture— especially if decisions become overly profit-driven. |

| 3. Access to Strategic Expertise CPE firms bring experience in scaling businesses, improving operational efficiency, and driving profitability—often through professionalised governance and systems. | 3. Pressure for High ROI and Exit PE has a defined time horizon (typically 3–7 years) and will push for aggressive growth and an eventual exit—often a sale or IPO. (Known as a ‘flip). |

| 4. Accelerated Growth With financial backing, firms can move quickly into new geographies or markets, acquire competitors, and scale niche services. | 4. Dilution of Ownership Existing partners must give up equity in exchange for capital. From the get go founders may hold only a minority stake. (Although there are examples of PE taking a minority stake). |

| 5. Talent Attraction and Retention Equity-linked incentives (e.g. options or profit-sharing schemes) can attract high-performing professionals who want ownership or upside in growth. | 5. Staff Disruption Uncertainty about changes in leadership, roles, or firm direction can unsettle staff. If not managed well, it can lead to attrition. |

| 6. Enhanced Valuation Through Transformation Digitalisation, specialisation, and consolidation driven by PE can increase the overall value of the firm beyond what could be achieved solo. | 6. Complexity and Legal Restructuring A PE deal often requires reorganisation of the firm structure (e.g., incorporation), changes to ownership rules, and significant legal and advisory costs. |

| 7. Debt Treatment Firms should be cautious around how the investment debt is treated. If it’s added to the firms own P&L then this creates greater risk and a significant repayment burden. |

Potential Challenges & Trade-offs

Engaging with PE isn’t without risk. Key challenges include:

- Cultural change

- Potential loss of autonomy

- Staff engagement

- Exit strategies

AGN members should assess whether they’re ready for the demands and shifts that come with PE capital.

What’s the Opportunity for AGN Members?

Valuations are typically based on a multiple of EBITDA, adjusted for growth potential, risk profile, and strategic assets. Factors increasing valuation include:

- Demonstrably strong client retention

- Revenue from advisory and niche services

- Scalable operating models

- Use of AI or cloud systems

- Leadership continuity

Multiple uplift can range from 5x EBITDA for traditional firms to 10–12x for digitally mature firms.

What members can do next?

AGN firms can:

- Learn from peers – AGN members include a raft of firms that have taken PE investment.

- Use diagnostics to assess readiness – The AGN Advisory Migration Diagnostic, the AGN Digital Maturity Diagnostic and the AGN Practice Performance Diagnostic.

- Explore advisory migration through discussions with AGN member firms that are advanced in their journey.

- Build regional platforms with scale – AGN includes members that have catapulted their growth and scale country based acquisitions.

Funding Future Investment 3: Bank & Debt Financing

Banks, credit organisations and other financial institutions allow firms to raise capital via debt—commonly through term loans, lines of credit, or specialized instruments. Accounting firms with stable revenue streams can often secure sizable loans, though usually with personal guarantees equity or seconded on Trading history or forecast future performance. While debt doesn’t dilute ownership, it does require repayment with interest.

| Benefits | Challenges |

|---|---|

| 1. Retain Full Ownership Firms maintain complete control. Unlike equity, bank loans don’t involve giving up any stake or inviting external influence on decisions. | 1. Repayment Risk Loan repayments are mandatory regardless of business performance. Revenue dips can strain finances, leading to potential default. |

| 2. Flexible Use of Funds Loan proceeds can typically be used for a broad range of business needs—from IT upgrades to marketing, hiring, or office renovations. This flexibility supports growth strategies like digital transformation. | 2. Interest and Fees Loans incur interest and potentially other costs (e.g., origination fees). With rising interest rates, the cost of new debt has grown. |

| 3. Tailored Terms Different loan types suit different horizons: Short-term: working capital or seasonal needs. Medium-term: growth projects. Long-term: durable assets like office buildings or major IT systems. | 3. Collateral and Guarantees Banks typically require collateral or partner guarantees, sometimes, not always, placing personal assets at risk. |

| 4. Lower Cost of Capital Interest payments (often tax-deductible) may be cheaper in the long run than giving away a share of profits to equity investors. | 4. Loan Covenants Loan agreements often contain restrictions. Breaching these may lead to penalties or loan recall. |

| 5. Familiar, Streamlined Process Banks have established lending procedures and often understand professional service firms. Predictable revenues and strong client retention help firms qualify. | 5. Limited Capital Availability Loan amounts are constrained by cash flow and collateral and business performance. Medium-sized firms might secure less than equity could provide. |

| 6. No Strategic Input Banks offer no strategic advice or mentorship— just capital. |

When It’s a Good Fit

Bank financing suits firms with reliable income, financial discipline, and clear ROI plans. Examples include investing in new software or expansion that can be repaid from increased future revenue.

Preserving Independence

Debt financing doesn’t alter ownership. Profits stay internal after interest. While lenders may require transparency, they don’t interfere with governance.

Application by Time Horizon

Short-Term

Revolving lines of credit are ideal for temporary cash flow gaps or seasonal needs.

Medium-Term (1–3 yrs)

3–7 year loans suit projects like digital upgrades or launching new services.

Long-Term (3–5+ yrs)

Real estate or highly durable needs can justify 10+ year loans,

though they’re uncommon for

intangible investments.

Conclusion

Bank financing is a practical, non-dilutive funding route for medium-sized firms. It supports independence and growth if firms are financially disciplined and confident in their repayment capacity.

Funding Future Investment 4: Employee Stock Ownership Plans (ESOPs)

An Employee Stock Ownership Plan (ESOP) allows a firm to transfer ownership to employees through a trust, often using a loan (leveraged ESOP) to buy partner shares. Over time, profits repay the loan and shares are allocated to employees— usually based on salary or tenure. It’s a form of internal succession and financing, with the added benefit of boosting engagement and retention. Though rare in accounting, ESOPs are gaining traction after BDO USA’s notable adoption in 2023.

| Benefits | Challenges |

|---|---|

| 1. Strong Talent Retention and Attraction ESOPs give employees a stake in the firm’s success, often boosting loyalty and engagement. As a no-cost retirement benefit, it helps firms stand out in recruitment and signals a people-first culture. | 1. Complex and Costly Setup Creating an ESOP requires restructuring as a corporation, hiring specialists, annual valuations, and ongoing regulatory compliance. These administrative costs can be burdensome for smaller or less profitable firms. |

| 2. Internal Ownership Transition ESOPs preserve independence—ownership transfers to employees, not outsiders. Leadership remains intact, and governance can be structured to retain partner control, making it a strategic way to raise capital while staying private. | 2. Financial Risk via Debt Many ESOPs require loans, creating substantial debt that the firm repays over time. If cash flow falters, the burden can strain finances—especially in firms without strong recurring revenue. |

| 3. Succession and Liquidity for Partners Selling to an ESOP allows retiring partners to exit gradually or all at once. The firm buys equity at fair market value via ESOP loans or contributions—often offering better terms than internal sales while preserving the firm’s legacy | 3. Ownership Dilution Partners’ equity shrinks as shares transfer to employees. Though philosophically easier to accept than outside investors, it still changes firm dynamics and requires partners to embrace a broader ownership model. |

| 4. Tax Benefits In some countries contributions to the ESOP are tax-deductible, and in S-corps, profits attributable to ESOP ownership can be tax-free and/or sellers may defer capital gains tax. The tax advantage vary. | 4. Future Repurchase Obligation In some ESOP arrangements, employees retire or leave, the firm must buy back their ESOP shares. This liability can grow over time and must be planned for to avoid cash flow constraints later. |

| 5. Performance Gains Firms with ESOPs often outperform peers in productivity and profitability due to greater employee motivation. A culture of ownership can lead to better service, innovation, and retention—supporting long-term growth. | 5. Licensing and Regulatory Challenges Some jurisdictions limit non-CPA ownership. ESOPs must be carefully structured to avoid breaching regulations, particularly in audit-focused practices, potentially limiting the firm’s ability to go fully ESOP-owned. |

Suitability for Medium-Sized Firms

ESOPs work well for firms with steady profits, low debt, and a deep team—especially those facing leadership succession. If a firm has retiring partners and engaged staff, an ESOP can align interests, provide exit capital, and retain independence.

Applicability Over Time

Short-Term (Year 1)

Setting up takes 6–12 months. Immediate benefits include liquidity for selling partners and a morale

boost from employee ownership. Operationally, the firm sees little change—no immediate growth or

client influx.

Medium-Term (1–5 yrs)

The firm begins servicing the ESOP loan, adjusting cash

flow. Employees start seeing themselves as owners, which can improve engagement

and retention. The firm might start attracting talent with its employee-owned status and market itself differently.

Long-Term (5–10+ yrs)

RWith the loan repaid, the firm’s financial position strengthens.

Employees accumulate

meaningful retirement value. The firm may complete its succession plan via additional

ESOP transactions and sustain a strong, independent model.

Ownership Impact

A typical ESOP transaction sees the trust owning 20–40% of the firm. Employees benefit economically, but governance often remains with partners or a designated trustee. Over time, some scenarios mean that firms can transition to 100% employee ownership—though many remain partially ESOP-owned to balance control and shared benefits.

Conclusion

An ESOP is a strategic, long-term ownership and capital solution—not a quick fix. It supports gradual succession, can build a performance culture, and is likely to help firms preserve independence while rewarding staff. For medium-sized firms with a long view and strong fundamentals, ESOPs can support cultural and financial continuity.

Funding Future Investment 5: Internal Partner Funding

Internal funding involves using the firm’s own partners—current or incoming—to raise capital. This can be through capital contributions, retained earnings, or new partner buy-ins. It’s a traditional method that keeps ownership within the firm, often facilitating generational succession.

| Benefits | Challenges |

|---|---|

| 1. Preserved Control and Culture Ownership stays within the practitioner group, maintaining the firm’s culture, autonomy, and long-term service values. No external influence alters strategic decisions. | 1. Limited Capital Funds are constrained by partners’ personal means or firm profits. Buy-ins, while valuable, are often modest compared to what external investors could offer. |

| 2. Trusted and Familiar Processs Internal funding involves people who know the firm, making transitions smoother. Retiring partners can often choose successors, and trust simplifies negotiations. | 2. Personal Financial Burden New and existing partners may need personal loans or dip into savings or access to a firms banking equity loan. This can deter prospective partners, affecting retention and succession. |

| 3. Flexible Terms Buyouts and capital injections can be structured to suit cash flow—payouts spread over years, staged buy-ins, or firm-arranged loans—all negotiable internally. | 3. Slower Growth form Investment Strategy Growth maybe more gradual, limited by internal resources. Larger investments may be postponed or broken into phases, risking competitive disadvantage. |

| 4. Talent Development Incentive Creating ownership opportunities motivates high performers. Offering equity stakes fosters loyalty and strengthens the leadership pipeline. | 4. Strain from Retirement Payouts Deferred payments to retiring partners can drain profits—especially with multiple retirements— reducing funds available for growth. |

| 5. Simplified Regulatory Compliance No need for outside approvals or restructuring. As new owners are typically licensed professionals, ownership remains in compliance with regulatory standards. | 5. Risk of Inequity or Tension Differences in buy-in amounts or timing may lead to perceived unfairness. Ownership could skew toward those with deeper pockets, rather than merit. |

Suitability for Medium-Sized Firms

Internal funding is ideal for stable, independently minded firms with upcoming leaders. It suits planned, moderate capital needs—like phased tech upgrades or service expansion—and firms aiming for long-term sustainability.

For instance, a 15-partner firm with retiring seniors and rising managers might use this model to transfer ownership and raise funds simultaneously. It works well when firms reinvest profits year over year, supporting continuous but controlled evolution.

Use Across Timeframes

Short-Term

Firms can defer distributions or call

for small capital injections from partners to manage short-term needs. These measures help bridge cash flow gaps or seed smaller projects.

Medium-Term

A plan to admit new partners and retain earnings over 1–5 years can fund initiatives like office expansions or IT upgrades. Discipline and forecasting are key.

Long-Term

A steady intake of new partners and ongoing reinvestment builds capital slowly but

securely. Firms might allocate a percentage of revenue annually

into a development or tech fund—aligning capital formation

with strategy.

Ownership Impact

Internal funding maintains full control within the partner group. While equity percentages shift as partners enter or retire, there’s no external ownership dilution. New partner contributions strengthen the firm’s balance sheet and

support future investments.

In some firms, senior staff may hold small stakes, but ownership still remains internal. This approach reinforces legacy and succession, creating continuity from one generation of partners to the next.

Limitations and Considerations

Internal funding can struggle to meet urgent or large-scale investment needs. For example, a sudden need to adopt an expensive new audit platform might exceed the firm’s internal capacity. If no one is willing or able to buy in, internal succession plans can falter, making external

funding necessary.

For these reasons, many firms use internal funding as a foundation but remain open to supplementing it with loans or outside capital for larger or time-sensitive projects.

Conclusion

Internal partner funding is the most traditional financing method for professional service firms. It supports control, stability, and long-term continuity, but comes with limits on capital availability and speed.

It’s most effective when aligned with a forward-looking succession plan and used for investments that can be planned and phased over time. For medium-sized accounting firms prioritizing independence, internal funding provides a reliable, sustainable approach—especially when supplemented with other capital sources as needed.

Funding Future Investment 6: Mergers or Acquisitions (Strategic M&A)

Merging with or being acquired by another firm can inject capital, solve succession issues, and provide scale. It trades independence for resources and often forms part of consolidation strategies in the accounting sector.

| Benefits | Challenges |

|---|---|

| 1. Immediate Scale & Resources Gains access to tech, clients, and infrastructure of a larger firm. | 1. Loss of Identity Merging typically ends a firm’s independent branding and culture. |

| 2. Partner Liquidity Partners can cash out or take shares, reducing risk. | 2. Client/Staff Disruption Risks include client attrition, redundancies, and morale issues. |

| 3. Staff Opportunities Offers broader career paths and may improve retention. | 3. Strategic Shift Risk Larger firm may phase out services or clients the smaller firm values. |

| 4. Succession Planning Solves retirement transitions without needing internal successors. | 4. Earn-outs & Status Loss Deals may include performance targets, and former partners might lose authority. |

| 5. Potential Equity Upside Partners may benefit from larger firm’s future growth if shares are received. | 5. Regulatory Changes New compliance obligations (e.g., independence rules) may apply. |

Suitability

Ideal for firms lacking internal succession or facing tech/cost pressures. A one-time, long-term strategic shift offering short-term liquidity and stability under a larger platform.

Ownership Impact

Original ownership dissolves. Partners either cash out or join a larger ownership pool. This is full dilution in exchange for future security and support.

Funding Future Investment 7: Public Listing or IPO (Initial Public Offering)

An Initial Public Offering (IPO) represents a bold capital-raising move—opening a professional services firm to public investment by listing on a stock exchange. Although rare in the accountancy world, a handful of firms, particularly in legal and advisory services, have paved the way. Going public can unlock substantial capital, raise brand visibility, and enable rapid expansion—but not without significant governance and regulatory burdens.

| Benefits | Challenges |

|---|---|

| 1. Access to Large-Scale Capital IPOs can raise significant funds for expansion, acquisitions, or technological upgrades. Large institutional investors often provide long-term backing. | 1. Regulatory Hurdles Professional ownership restrictions vary by jurisdiction. For instance, audit firms are often precluded from going public. |

| 2. Enhanced Brand Credibility Public companies typically gain prestige, improving client trust and attracting top talent. | 2. Cultural Shift Required Public ownership changes the firm’s focus—from partnership culture to shareholder value— potentially undermining legacy values. |

| 3. Liquidity for Existing Partners IPOs can offer partners a chance to realise part of their equity, enhancing personal financial flexibility. | 3. Market Pressure for Short-Term Result Quarterly reporting cycles and shareholder expectations may force firms to prioritise profit over long-term value or client care. |

| 4. Acquisition Currency Listed shares become a useful currency for M&A, allowing firms to scale faster by issuing stock instead of cash. | 4. Loss of Privacy and Control Listed firms face continuous disclosure obligations, open public scrutiny, and must navigate shareholder activism. |

| 5. Governance Public firms must meet rigorous reporting and governance standards—perhaps driving better internal processes. | 5. High Cost and Complexity of Listing The IPO process requires expensive advisors, regulatory filings, and may take 12–24 months to complete. |

Suitability for Medium-Sized Firms

The most high profile listing of firm listings took place in the early 90s with the likes of Numerica and Tenon floating on the UK AIM exchange – a not entirely successful venture. However, listing is back in vogue if in a lower key format largely for the legal sector; Knights Group (UK Law Firm): Listed on the London Stock Exchange AIM in 2018. The Australian legal sector saw firms like Shine Lawyers and Slater & Gordon have listed successfully, demonstrating that professional service businesses can work as public companies—if structured properly.

For most AGN members, a full IPO may not be an immediate option, however, the idea of a quasi-public route is evolving. Firms might:

- List only non-audit subsidiaries (e.g. consulting or digital arms).

- Explore private placements or mini-bonds via capital markets.

- Use ESOPs as stepping-stones to broader market participation.

Ownership Impact

- Original partners may retain a stake, but shareholder interests dominate.

- Board and executive governance become critical.

- Voting rights shift towards institutional or public investors.

The autonomy of the founding partners is reduced—but capital availability and future liquidity options are greatly enhanced.

Application Across Timeframes

Short-Term (0–2 yrs)

Begin preparing by incorporating, auditing financials, building governance structures, and exploring alternative market models (e.g. dual shares, carve-outs).

Medium-Term (2–5 yrs)

Firms may raise pre-IPO funds, test investor appetite, or launch a

minority IPO of a subsidiary.

Long-Term (5+ yrs)

Full-scale IPO possible—subject to jurisdictional reforms and sustained firm performance. A credible path if firm seeks market leadership.

Other Financing Options are available

| Government Grants or Subsidies: |

| – Some governments offer funding for tech or training. While modest, these are non-dilutive and suitable for short-term, specific projects. |

| Venture Capital / Angel Investment: |

| – Not typical for accounting services, but viable if spinning off a tech product. The core firm stays independent, while the innovation entity raises external capital. |

| Crowdfunding / Private Stock Offering: |

| – Rare due to regulations, but possible through private placements or in countries allowing public listing of professional. |

| Private Family Office “Evergreen” Investment Model: |

| – Long-term capital investment from a family office instead of PE firms. – More patient capital, focused on steady growth rather than fast exits. – Allows firms to remain independent while securing funds for development. |

| Hybrid Partnership-PE Model: |

| – Maintains a core group of equity partners while selling a minority stake to PE investors. – Balances external capital for growth while retaining traditional partnership governance. – Helps existing teams maintain control and cultural integrity. – AGN Swedish member Frejs has taken this approach with a minority investment from AdeliS into a new parent organisation called Cedra. |

| Cooperative Ownership Model: |

| – Shared ownership between employees, partners, and even clients or industry stakeholders. – Encourages long-term decision-making and aligns incentives across all stakeholders. – Rare but viable in professional services where sustainability and independence are priorities. |

| Strategic Alliances with Shared Ownership Pools: |

| – Instead of full mergers, firms create equity pools across multiple firms. – Used to create economies of scale, share tech investments, and enable joint market expansion. – Could work well within international associations like AGN to build integrated service offerings without ceding full PE control. |

| Minority Investor + Employee Option Pool: |

| – External investors take a minority stake while employees get share options. – Reduces challenge of cultural shift compared to full PE ownership. – Provides liquidity while keeping leadership incentives aligned |

Conclusion

The ability to raise and deploy capital strategically is an increasingly important factor for successful modern accounting firms. Whether it’s attracting private equity, borrowing from a bank, unlocking internal funds, forming alliances, building an ESOP, or merging with a peer, each pathway has a place in a firm’s journey.

AGN members are encouraged to reflect on their current and future needs—balancing ambition, independence, and succession planning. In many cases, a hybrid approach offers both agility and stability. Use this guide as a diagnostic and discussion tool with your leadership team as you build your future-ready firm.

Mini podcast

Tune into our mini podcast on Spotify for a quick summary of the key insights.

Copyright © 2025 AGN International Ltd. All rights reserved. No part of this publication may be reproduced, distributed, or transmitted by non-members without prior permission of AGN International Ltd.