AGN EMEA Taxation Task Force (TTF) Newsletter

In Switzerland, new provisions on inheritance law will come into force on 1st January 2023 – What does this mean?

The new provisions will increase the available quota (of one’s property one can dispose of) for testators to plan their assets and beneficiaries. This allows testators to have a larger share of their estate available, e.g. for non-legal heirs.

What are the new features of the Swiss Succession Law?

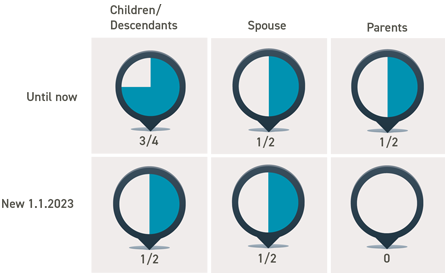

- The most important new feature of the reform concerns the reduction of the statutory entitlement of descendants from the current 3/4 to 1/2 of the right of inheritance.

- The abolition of the statutory entitlement of parents.

- The statutory entitlement of the surviving spouse and registered partner remains unchanged.

Change for divorcing couples

In the case of an ongoing divorce, under the existing law, spouses remain each other’s heirs until their divorce decree becomes final. As of 1.1.2023, under certain circumstances, the surviving spouse or registered partner may lose his/her forced heirship right during the divorce proceedings if:

- Divorce proceedings were initiated jointly or continued on a joint request; or

- The spouses have lived separately for at least two years – before or during the proceedings. Concubinage still does not provide for a right of succession regulated by law.

Cohabiting partners continue to have no statutory entitlement to inheritance. The benefits for cohabiting partners must therefore continue to be regulated in the will or a contract. The tax situation has also not changed: depending on the canton, the inheritance received by a cohabiting partner is still subject to an inheritance tax of up to 45%.

Inheritance/Gift tax in Switzerland

There is no federal tax on inheritance or gifts, but almost all Cantons levy inheritance and a gift tax – due on worldwide income and assets.

The calculation is based on the degree of family relationship and the net estate value transferred to the heirs:

- No canton levies inheritance/gift tax against the (surviving) spouse or registered partner;

- Children are mostly tax exempted, whereas;

– four cantons (AI, NE, LU (community level only) and VD) levy tax on inheritance to direct children;

– three Cantons levies tax on gifts to direct children (AI, NE, and VD). - The more distant the relationship, the more cantons levy inheritance and gift tax at increasing rates.

- Non-related and appointed heirs can pay up to 45% of their part.

In Switzerland, the heir or recipient of the gift is liable for the tax burden; however, in solidarity with the donor.

For a restricted number of countries, a Double Taxation treaty for Gift and Inheritance Taxes is in force.

Do you have any inheritance and gift tax-related questions?

We recommend that existing provisions (wills and nuptial agreements as to succession already concluded) be revised to make the most of the increased flexibility of the new rules of the Swiss succession law, together with accurate tax planning.

Taxation Task Force members and AGN tax correspondents are available

to answer your questions and help you!

If you have any questions regarding succession and gift issues in Switzerland, please contact Rocco Arcidiacono.

Rocco Arcidiacono

Partner & Swiss certified tax expert, TEP

Fiduciaria Mega SA